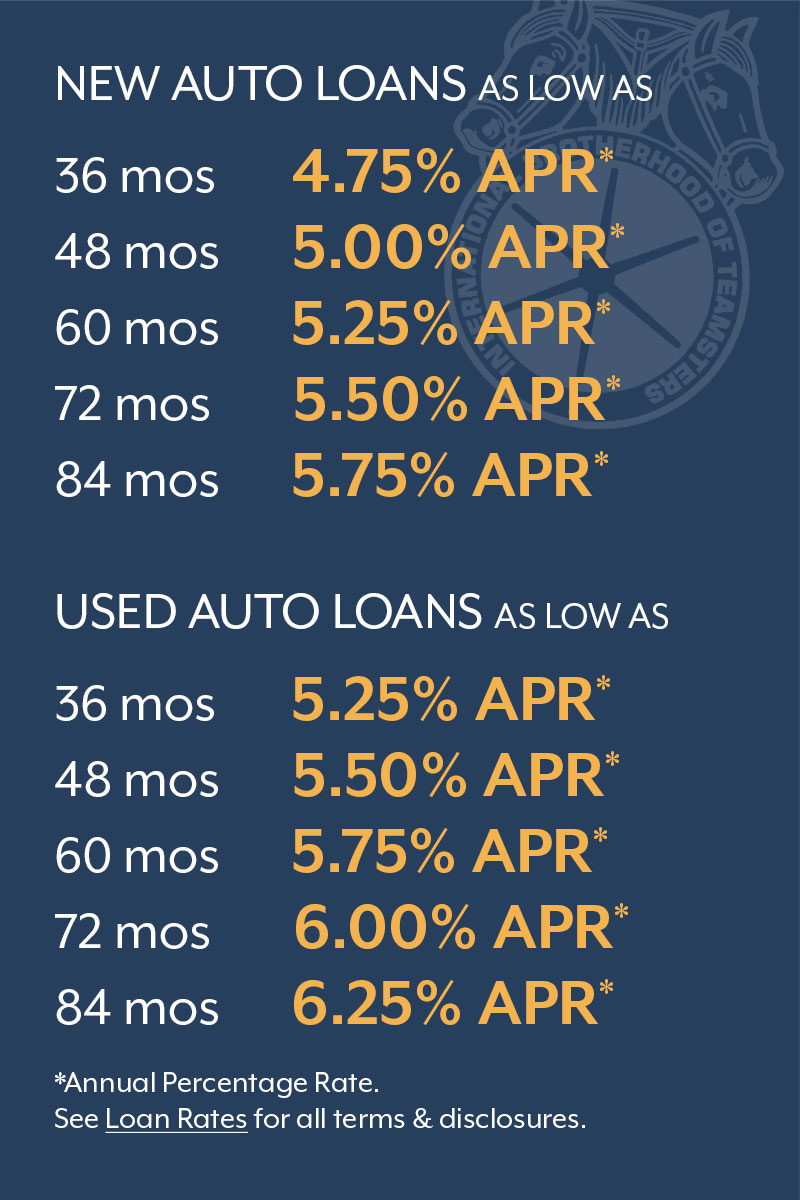

When it comes to new cars, low cost financing from your credit union plus the dealer’s best cash price is usually the way to go. But new car or used, you’re likely to find that the best rates you can get are right here at TCU. Your actual rate is determined by the length of loan and your credit qualifications. If you have us pre-approve your loan at no cost, you essentially become a cash buyer, which is helpful when you negotiate price. Whatever you do, be sure to check with us before you accept other financing. There’s a good chance we can beat it!

Get TCU Financing Right at the Auto Dealer!

You can get low cost TCU financing right at most dealerships! All you have to do is ask for it. The dealer can arrange your credit union loan at the same time you buy your car. Enjoy the convenience of 1-stop shopping! Most auto dealers in our area participate in this program. Visit the AutoSMART web site to locate specific dealerships.

Helpful Car Buying Tools

At the AutoSMART site you can also search for vehicles, obtain CarFax reports, look up Kelley Blue Book and NADA prices, obtain car buying tips and information, and use a payment calculator. This is a smart way to begin your selection and buying process!

Auto Solution: They Shop & Save For You!

For even greater convenience, ask the pros at Auto Solution to locate the vehicle you specify and offer it to you at a very competitive price. There’s no obligation, and there’s never any stress or pressure. Instead of spending time shopping the dealers yourself, you can skip all the searching and haggling! Call 503-238-2429 or 1-800-207-2429. Or visit the Auto Solution web site.

Mechanical Breakdown Protection

Instead of a costly extended warranty sold by the dealer, consider Mechanical Breakdown Protection (MBP) for your vehicle, which we make available through Allied Solutions. Click here to get an instant quote and learn more about the benefits of having Mechanical Breakdown Protection.

Affordable Credit Insurance to Protect Your Family

As your financial partner, we also want to protect the investment you make in a credit union loan. We offer optional Credit Disability and Credit Life Insurance that makes loan payments for you if you are disabled, or pays off the loan if you meet an untimely demise. Coverage is available for a nominal cost that can be included in your monthly payments. It’s one less financial stress for your family if the worst should happen. We also offer Guaranteed Auto Protection (GAP), which makes up any difference between what you owe on your vehicle and what it’s worth, if the vehicle is totaled.

Skip-a-Payment Program

Each year our members with consumer loans have the opportunity to defer a loan payment during the holiday season. Our “Skip-A-Payment” program gives participants extra cash at the time of year when it’s needed most.

Click here for the Skip-a-Payment request form.

Teamster Strike Policy

Look to your credit union for help in the event of a Teamsters strike or lock-out. We have the most liberal loan extension policy in the nation, up to six months for all but real estate loans (and we’ll even modify those, when feasible).

Resources

Click here to apply for a loan.

View our current loan rates, fees, and other related information.

Use our payment calculator to calculate loan payments, interest, and more.

Discover a suite of car buying tools to make your next auto purchase easier and more hassle free.

Let us find your perfect vehicle! We do all the work for you to make your auto buying experince a good one!

View our current loan rates, fees, and other rare related information

Access the Oregon Department of Motor Vehiclesfor legal auto buying forms.

Access the Washington Department of Licensing for legal auto buying forms.

Each year we allow our members to skip one loan payment during the holiday season.